Sally,

In the USA (and very likely Canada) the only “tubed” pumps currently in production are those made by MedT (MedTronic) and the Tandem X2. Such pumps with “tubes” going from the pump to the infusion set on your tummy qualify for Traditional Medicare Part B (DME) coverage.

The Omnipod style pump is a direct connect device and is not approved for Part B (DME) coverage, but (as I already noted) was just approved for Medicare coverage under the Part D (RX) plans. As noted … not all insurance providers of the Part D (RX) plans have the Omnipod in their formulary. Even so … it is expensive and will push a user to the infamous donut hole in a heartbeat.

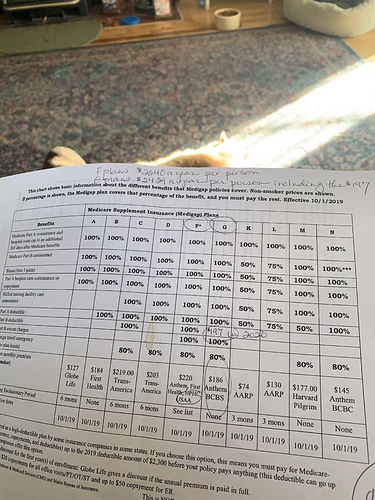

I’ve attached a link that provides an explanation between the Medicare Advantage and Traditional Medicare offerings. Traditionally people using insulin pumps and CGMs fare much better with Traditional Medicare and a Supplemental (MediGap) plan. Medicare A & B are “traditional” Medicare. Then you can add a Part D (RX) plan and a Supplemental (MediGap) plan if you like. Plan F is still available if you sign up like right now as it will no longer be available to ‘new subscribers’ as of 01/01/2020. Plan G will still be available for new subscribers and costs less per month. See comments below about that.

Enbrel is a drug and that is/would be covered under Medicare Part D (RX) plans. Again depending upon the formulary for the insurance company and that plan. It is known as a “specialty” so does cost far more. I’ve attached a link for some data about Enbrel and Medicare as well. The one article on Enbrel linked below provides another link into the Medicare.gov site where you can enter your zip code and do some more searching for education on Enbrel and Part D (RX) coverage.

The Enbrel will have absolutely nothing to do with you signing up for Medicare and Part B and getting a supplemental (MediGap) plan. Supplemental plans F & G are both the same, but the F plan has a higher monthly premium, but you do not have an annual deductible. Plan G (which is what I have) has the same coverage and a one time annual deductible of about $185.

With Medicare Part B (DME) and my Plan G all my doctor visits, insulin pump supplies and insulin and CGM (Dexcom G6) are fully covered at 100%. I still get to pay whatever percentages for the various RXs I have for blood pressure, cholesterol, etc…

The MedT 670G is an OK pump and ties in with the MedT CGM. Problem is that the MedT CGM has not been approved for coverage by Medicare. If you are considering a pump and possibly might add a CGM in the future I would strongly recommend getting the Tandem X2 pump. It is a great pump and also will communicate with the Dexcom CGM G6 device. AND … AND … they are both fully covered by Medicare.

As for Medicare Advantage … I would not entertain at all and that is due to my diabetes, insulin, insulin pumps, CGM. Also on traditional Medicare I can pick/choose my Endo and all other doctors. The MA plans are like the HMOs in the commercial world. You typically have to use the doctors and facilities in “their network” and often those networks are very limited.

In fact many doctors and hospitals won’t accept patients with MA plans. So be very aware of such. They often spin a good line, but I don’t trust any of them.

Link for Medicare Advantage & Traditional Medicare explanation:

Enbrel Cost under Medicare Part D (RX)

https://medicareblog.org/enbrel-cost-with-part-d/

Best of luck. Hopefully some of this will be helpful to you.

Cheers,

Nolan K.

North Texas