In 2013 I become an independent contractor after 10 years with the same employer. We always had good health insurance through the company sponsored plan. The company subsidized the insurance plan so our premiums was barely $200 out of pocket. The plan covered 90% of costs. My CGMS was fully covered. So was my insulin pump.

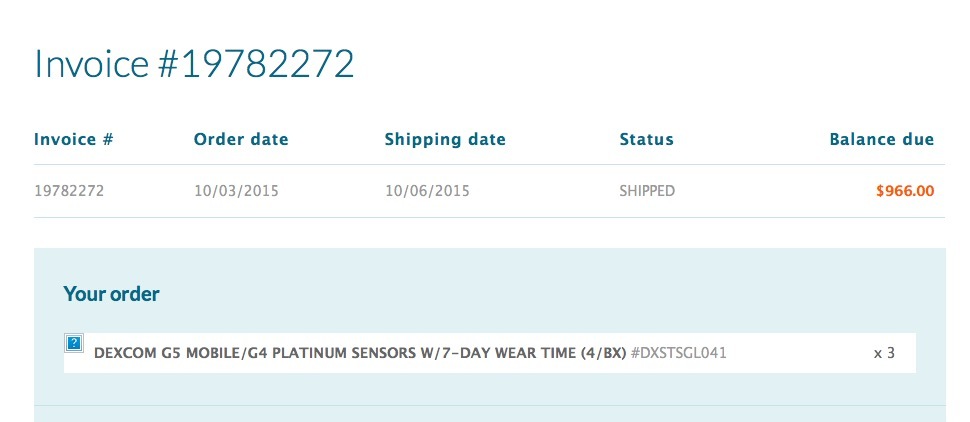

After I left, I kept the insurance plan, paying about $1900 through COBRA for a family of four. Then in 2014, COBRA expired and we found insurance through the exchange. Almost $2000/month for a family of four. But the top tier Platinum plan covered only 90% of dr visits and only 50% of equipment costs. I pay $996 every four months for CGMS sensors.

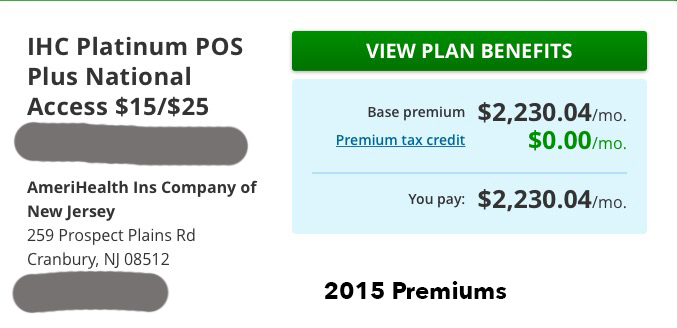

Then in 2015, the insurance company raised the premium to $2230/month. Exact same plan, save coverage, same deductible, same family of four. So I paid over $250 per month extra for the same insurance product.

From what I have read, the insurance company has petition the State of New Jersey for an increase in premiums. Same product, same coverage.

It’s not yet clear how much the marketplace premiums will increase since any increases must undergo state regulatory scrutiny before they’re finalized. However, four of the six marketplace insurers have proposed double-digit premium increases: Aetna, 30.3 percent; Health Republic of New Jersey, 17.99 percent; Horizon Blue Cross Blue Shield of New Jersey, 10.8 percent; and UnitedHealthcare, 15.65 percent. The other insurers – AmeriHealth New Jersey and Oscar Health Insurance – are proposing increases of less than 10 percent, the threshold for reporting the proposals to the federal government in June. ~ HEALTH INSURANCE SIGN-UPS HOLD STEADY, BUT MORE FAIL TO KEEP UP WITH PREMIUMS

Someone please explain to me how the Affordable Care Act is affordable?

NOTE: The fines for non having insurance have been raise to 2.5% of income.